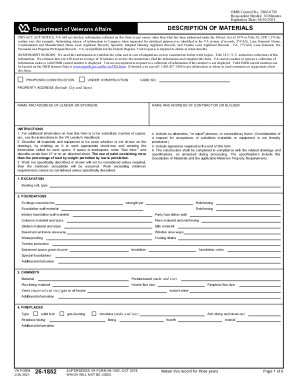

VA 26-1852 2024-2026 free printable template

Show details

This form is used to provide a detailed description of materials and equipment to be used in construction for VA loan applications under the Loan Guaranty program.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign va 26 1852 form

Edit your va form 1852 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 26 1852 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit va form 26 1852 pdf online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit how to fill out va form 26 1852 08. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA 26-1852 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out va 26 1852 2024 2025 789 reviews form

How to fill out va form 26-1852

01

Obtain VA Form 26-1852 from the official VA website or local VA office.

02

Read the instructions carefully provided at the top of the form.

03

Fill in your personal information in Section 1, including your name, address, and contact information.

04

Complete Section 2, which relates to the property for which you are seeking a loan.

05

In Section 3, indicate your service history and provide necessary documentation if required.

06

Review Sections 4 and 5 to provide any additional information required by the form.

07

Check for accuracy and completeness before signing the form at the bottom.

08

Submit the completed form to the appropriate VA office or lender.

Who needs va form 26-1852?

01

Veterans seeking a Certificate of Eligibility for a VA home loan.

02

Service members in active duty planning to purchase a home.

03

Surviving spouses of deceased veterans who are eligible for VA loans.

04

Individuals looking to refinance a current VA loan.

Fill

information va loan

: Try Risk Free

People Also Ask about va description of materials

How to get a loan with no credit?

IB Loan means any loan substantially effected through the CFB IB Operation and any other loans of such types or categories and in such amounts as are agreed upon by the parties hereto, together with any Accrued Interest Receivable thereon, the related servicing rights and all records associated therewith. "

How do I get information from a bank loan?

Here are some of them: Check your loan statement. The loan statement that your bank issues after your loan is sanctioned will have all the details regarding your loan, including your loan account number. Log in to your bank's website or app. Call on the bank's toll-free customer care number. Visit any branch of your bank.

How can I get personal loan information?

Information based lending usually incorporates financial statement lending, credit scoring, and relationship lending. Viability based financing is especially associated with venture capital. Reliable for all the small ticket loan. The entity type not depending on the value of the business.

What is information based lending?

Loan repayment is the act of settling an amount borrowed from a lender along with the applicable interest amount. Generally, the repayment method includes a scheduled process (called loan repayment schedule) in the form of equated monthly instalments or EMIs.

What is an IB loan?

In the context of borrowing, principal is the initial size of a loan—it can also be the amount still owed on a loan. If you take out a $50,000 mortgage, for example, the principal is $50,000. If you pay off $30,000, the principal balance now consists of the remaining $20,000.

How do I find details of a personal loan?

If you visit the official website of a bank. You will be able to view 'loan' under 'products' section. Under loans, you can click on 'personal loan' which will direct you to a new page. You can click on 'Login' and using your log in credentials you can view your personal loan statement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my information form person in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your description of materials form and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I edit lead water distribution system va form on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit 261852.

How do I edit va form 26 0592 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like young morphis bach taylor llp. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is va form 26-1852?

VA Form 26-1852 is a form used by the Department of Veterans Affairs to apply for a Certificate of Eligibility for a VA-guaranteed home loan.

Who is required to file va form 26-1852?

Veterans, active-duty service members, and certain members of the National Guard and Reserves who wish to obtain a VA home loan must file VA Form 26-1852.

How to fill out va form 26-1852?

To fill out VA Form 26-1852, provide personal details such as name, social security number, service information, and details about the loan being applied for. Ensure all information is accurate and complete.

What is the purpose of va form 26-1852?

The purpose of VA Form 26-1852 is to determine the eligibility of veterans and service members for a VA home loan, ensuring they meet the criteria for the loan guarantee.

What information must be reported on va form 26-1852?

The information required on VA Form 26-1852 includes the applicant's full name, social security number, military service details, loan information, and other personal identifying details necessary for eligibility determination.

Fill out your VA 26-1852 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Which Va Form Is Used For Documenting The Loan Of Equipment And Property is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.